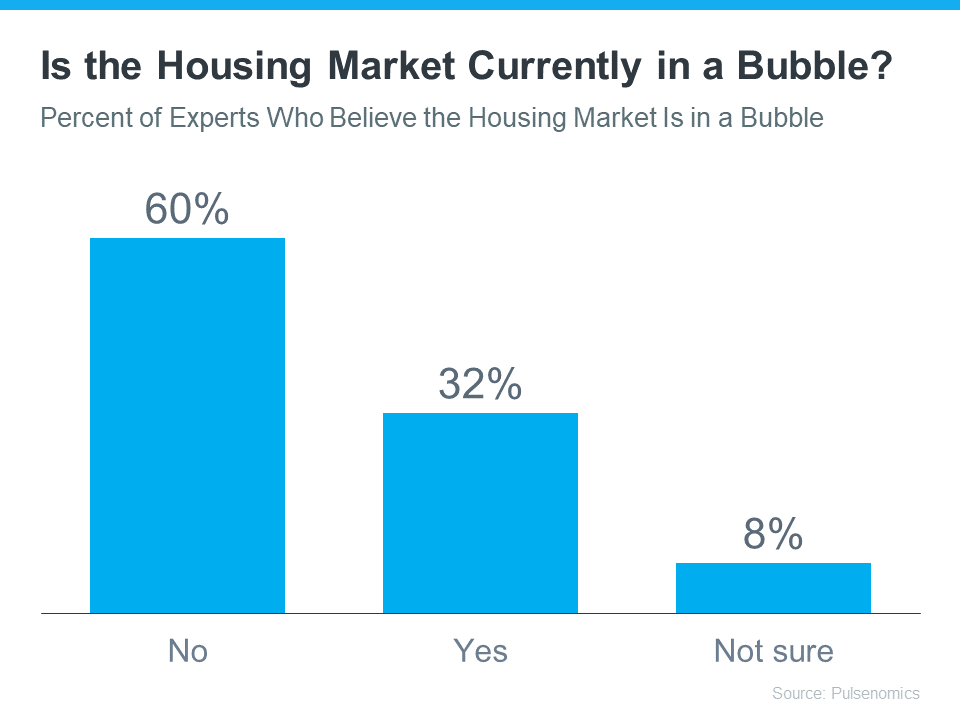

Everywhere you look, there are headlines mentioning a potential housing bubble or a crash, but it’s important to dig deeper to understand the data and listen to expert opinions to find a different story. For one thing, the Naples Florida real estate market trends higher than the national market and is stronger with a larger percentage of cash transactions. A recent survey from Pulsenomics asked over 100 real estate experts and economists if they think the housing market is in a bubble. In fact, 60% of them don’t believe it’s a bubble and we agree (see graph below):

As the graph shows, a strong majority (60%) said the real estate market is not currently in a bubble. There are many reasons why this isn’t like 2008 and here’s what the experts say:

- The exponential growth in home prices is due to population and a lack of inventory (there aren’t enough homes to support the influx of Millennial buyers who are ready to purchase and Boomers who are ready to downsize and move south)

- Credit risks are lower than 2008 due to more stringent underwriting and lending standards (but especially in Naples Florida where the majority of transactions are cash)

If you’re worried that a correction/crash is coming, here’s a look at two key factors that should help put your mind at ease.

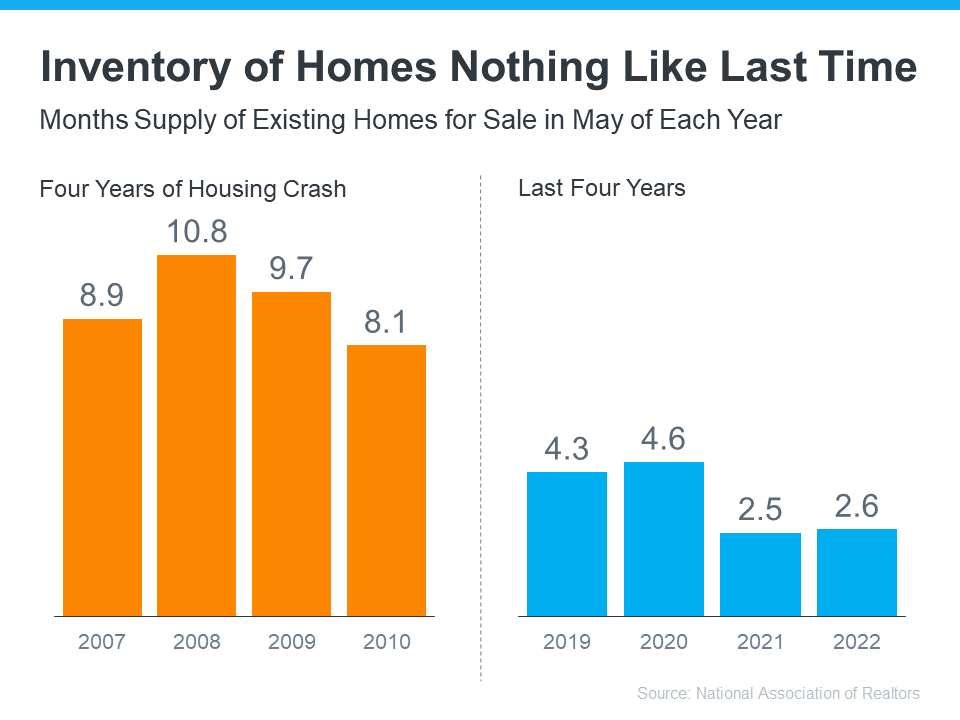

1. Low Housing Inventory Is Causing Home Prices To Rise

A balanced supply of homes for sale to support a normal real estate market is around the six month mark. Over that can cause prices to go down and properties will sit on the market longer. Less than six months is considered a shortage and causes continued price increases. Currently in Naples Florida we have less than 3 months real estate supply in inventory which is a huge increase from what we had during our winter season.

When you look at the graph below, the inventory levels in 2007 to 2010 (many of which were short sales and foreclosures) were too high and that caused prices to crash. Today, we still have a shortage of inventory, which causes increasing home prices (see graph below):

Inventory is nothing like the Great Recession and can’t even begin to compare to those levels. Prices are going up due to the need and demand for homeownership balanced by a limited supply of homes for sale. Odeta Kushi, Deputy Chief Economist at First American, explains:

“The fundamentals driving house price growth in the U.S. remain intact. . . . The demand for homes continues to exceed the supply of homes for sale, which is keeping house price growth high.”

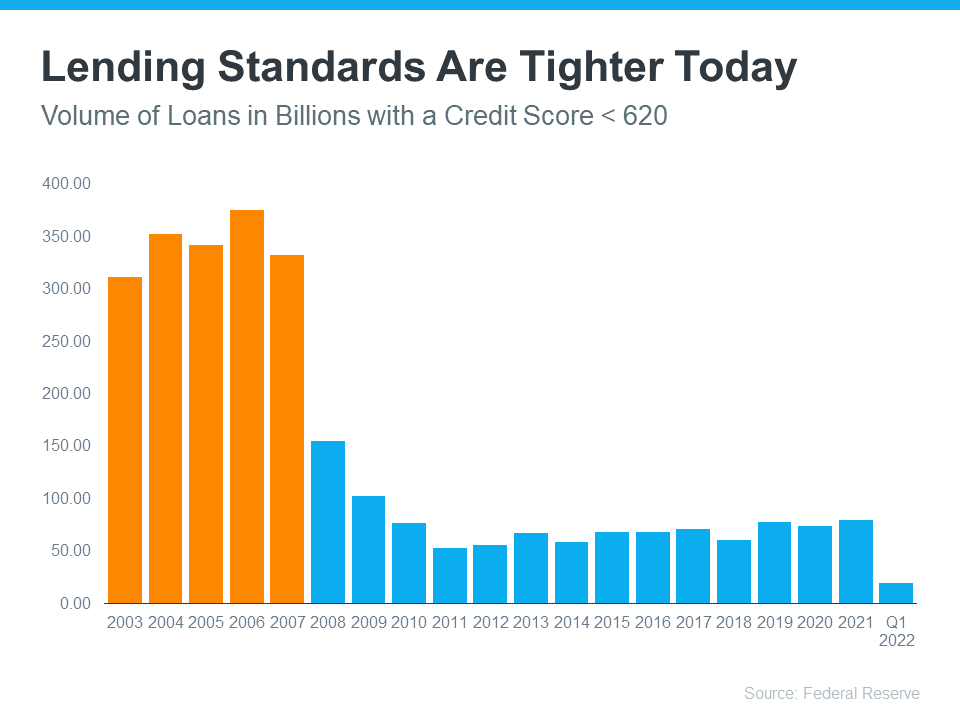

2. Mortgage Lending Standards Are Stricter than During the Great Recession

During the housing bubble of 2005-2007, it was ridiculously easy to get a mortgage. A majority of Naples Florida real estate buyers are not financing but if you are, we have some great Naples Florida lenders to put you in touch with. Below is a graph representing the mortgage volume given to buyers with a credit score less than 620 during the housing boom, and massively reduced number from 2008 to today:

This graph helps show how much higher mortgage standards are now than in 2003-2007. Anyone who received a mortgage over the last decade is much more qualified than those who obtained lending in the years leading up to the crash. Realtor.com notes:

“. . . Lenders are giving mortgages only to the most qualified borrowers. These buyers are less likely to wind up in foreclosure.”

Bottom Line

A majority of experts agree we’re not in a housing bubble and the main factors that would cause one are not here. We agree, especially in the Naples Florida real estate market. We have strong home price growth coupled with strong housing market fundamentals and strict lending standards. If you have questions, let’s connect to discuss why today’s Naples Florida real estate housing market is nothing like 2003-2008.